4 RULES IN IDENTIFYING A PROFITABLE RENTAL PROPERTY

The rules of real estate investing, have you heard of them? If not, we're going to explain four critical rules that everyone should know before buying a property. The most helpful “rules” are the 50% rule, the 2% rule, the 7-year rule and the rule of 72. All of these rules are intended to help you identify a rental property that can yield high cash flows

“Principles and rules are intended to provide a thinking man with a frame of reference.”

Carl von Clausewitz

Take these rules with a grain of salt. They are merely designed to make preliminary

assessments before doing your own due diligence. They are best used as a guideline

to help analyze and narrow down your search results in real time.

So let’s get right to it!

THE 50% RULE:

The 50% rule serves as a rule of thumb. It recommends doing a first-pass analysis of a rental property by calculating total monthly expenses.

According to this rule, the expenses incurred in operating a rental property will be roughly 50% of the gross rental income. In other words, the expenses on a rental property will equate to about 50% of the incoming rent. These expenses may include, but are not limited to; taxes, insurance, repairs, property management, vacation rental commissions, administrative fees, legal expenses, turnover costs, etc.

Considering we are referring specifically to the Riviera Maya market, there are a few caveats to this rule:

1) This a cash market so mortgage expenses don’t apply.

2) The rule traditionally is used in the U.S. where property taxes are substantially higher than here in Mexico (1/10th of 1%).

3) The rule typically applies to long-term rentals as opposed to vacation rentals.

*This being said I like to take off 15% of the said calculated rent to reach a more accurate assessment of your monthly outlook.

Let’s say you find a single-family condominium priced at $250,000 USD. Using your preliminary market research, and historic rental data from your realtor, you make the following conclusions. You can rent the condo as a vacation rental for 60% of the year, at $130 USD/per night. Using the 50% rule for a first-pass financial analysis, we find that all operating expenses would total about $1,008 USD per month:

219 days x $130 = $28,470 USD x 50% = $14,235 / 12 (months) = $1,186

$1,186 - $178 (15%) = $ 1,008 USD

HOA: $250 USD

Property Taxes: $20 USD

Utilities: $220 USD

PM/VRS Commission (25%): $296 USD

Insurance.: $150 USD

= $936 USD

As you can tell by using the 50% rule and comparing it to standard condo expenses your numbers come out similar to one another. Also, remember that property management costs are factored into the 50% expenses. So, if you plan to manage the property yourself, all fees that otherwise would have gone towards property management will now go to you.

2% RULE:

The 2% rule isn't exactly a formula. It’s more of a general guideline when needing to perform a quick calculation to gauge a rental property’s performance. It’s equally as simple as the 50% rule. It's said if the monthly rent of the rental property should be equal to or higher than 2% of the purchase price than it’s a “good” investment. In other words, you should get back 2% of your initial investment every month.

Example: For a $200,000 property, the monthly rent should be 0.02 x 200,000 = $4,000 per month or higher to qualify.

In this rule, you don’t need to account for taxes. This amount should be enough to pay for all expenses and generate a nice net yield at the end of the month.

You can also use this rule to work backward. Thus allowing you to determine how much to pay for the property.

For example, let’s take a property that will gross $5,000 USD per month in rental income. The rule applies to the question...how much should I pay for that property, given that it rents for $5,000 a month. When you apply the 2% rule, the answer is $5,000 / 0.02 = $250,000 USD.

The 7-year rule:

The 7-year rule essentially states that a property should be paid off in 7 years (or less).

The math beyond this rule is very simple as well. The hardest part is estimating the income that each property will gross.

This rule works whether you go all cash or you borrow money from the bank. However, if you are taking out a mortgage, or home equity loan, the 7-year rule typically does not apply due to the cost of interest.

The Rule of 72:

The rule of 72 determines how long an investment will take to double. This applies if you have a fixed annual rate of interest with your mortgage, or in most cases here in Mexico; a cash purchase.

It works like this: Divide 72 by the annual rate of return. The equation calculates the number of years it will take for the initial investment to double.

Example: The rule of 72 states that $1 invested with a 10% annual ROI would take 7.2 years ((72/10) = 7.2) to turn into $2. In reality, a property that is netting you 10% ROI will take 7.3 years to double ((1.10^7.3 = 2).

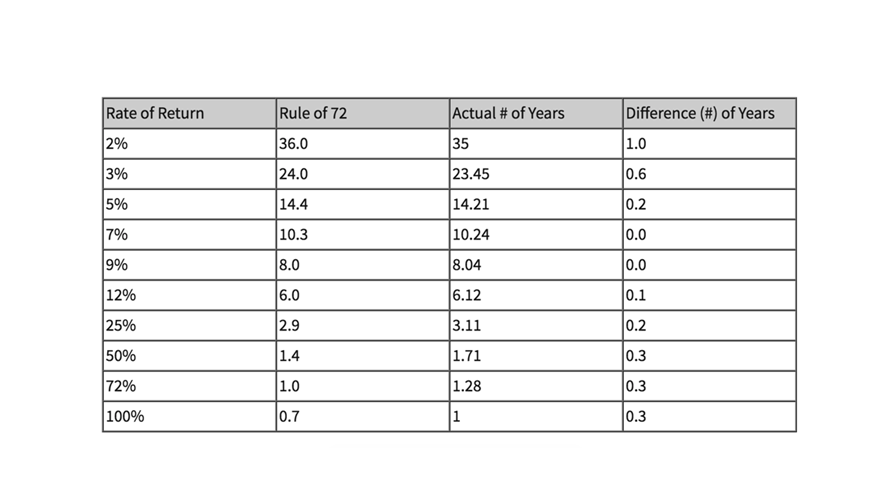

When dealing with rates of return from 5 - 12%, the rule of 72 is moderately accurate. The chart below compares the numbers given by the rule of 72 and the actual number of years it takes for an investment to double.

Remember, rather than using these rules of thumb to make your final decisions, use these rules for “off-the-cuff” assessments to determine if a property is worth looking into further.

NOTE: These rules come in handy when you want to narrow down your search while touring numerous investment properties with similar locations, sizes, and amenities.

NOTE: The goal of rental property investing is not just about owning one property.

The goal is to have a diversified portfolio of numerous cash flowing properties. When you look at

only one property return, it may seem low.

However, when you multiply that number by 5 or 10 you will see a significant increase in your annuities, otherwise referred to as compound interest. The concept of annuities will be covered in next weeks blog. Stay tuned for more helpful information about rental property investing.

Library

Contact us

Ryan Gravel

Ryan Gravel is an American real estate broker and developer. He began his career at a young

age working for his family owned construction company.

After graduating college at the University of Central Florida with a degree in business,

Ryan set out to find untapped prolific markets around the world. His search landed him in

Playa del Carmen, Mexico where he founded Virgin Realty Mexico and co-founded the Saatal

Development Group one of the fastest growing development companies in the Riviera Maya.

With extensive market knowledge, professionalism, etiquette, innovation and integrity Ryan

is known as one of the most highly respected real estate advisors in the region.